Most contractors know they should offer financing, but the actual rollout is where the wheels fall off. Between managing multiple lender logins, training reps who are afraid of "math conversations," and worrying about credit declines, the whole process can feel like more trouble than it’s worth.

But in a market where 92% of homeowners say cost is their biggest barrier, you can't afford to let "paperwork" stand in the way of a $25,000 project.

Below, we’re breaking down the exact, step-by-step framework for building a financing program that actually works in the field—without adding hours of admin work or confusing your team.

Step 1: Selecting Your Partner (The "Stack" vs. The "Struggle")

If you’re starting from scratch, the first hurdle is deciding how to access lenders. Many contractors make the mistake of signing up with one big-name lender. While it feels simple at first, a single-lender approach is a growth bottleneck; if that bank tightens its credit requirements or declines your customer, the deal is dead on the spot.

To maximize approvals, you need a multi-lender stack. However, be wary of platforms that claim to be "multi-lender" but still force your team to manage five different logins and re-enter data into multiple portals. This creates friction that leads reps to default to their one "favorite" lender—even if it isn't the best fit for the homeowner.

When evaluating partners, look for these operational non-negotiables:

- A Single Soft-Pull Application: Your team should fill out one form that triggers a soft credit pull to find the best match without damaging the customer's credit score.

- Routing Intelligence: The platform should automatically route the app to the lender most likely to fund that specific credit profile so your reps don't have to be finance experts.

- Beyond the Software: Financing is complex and carries compliance risks. Avoid providers that "drop off" the software and leave you to figure out the regulations and talk-tracks alone.

- Real Partnership: Look for a partner that provides hands-on sales training and live-chat support. When a rep is sitting at a kitchen table at 7 PM and hits a credit freeze, they need an answer in seconds, not a support ticket that gets answered in two days.

The goal is to move the heavy lifting of financing away from your sales reps and into a guided system that combines the right technology with expert coaching.

Step 2: Present Financing in the Home (When and How to Introduce It)

Financing shouldn't be a "Plan B" used only when a customer balks at the price. If you wait until the end of the presentation to bring up money, you've already let "cost anxiety" build up in the customer's mind.

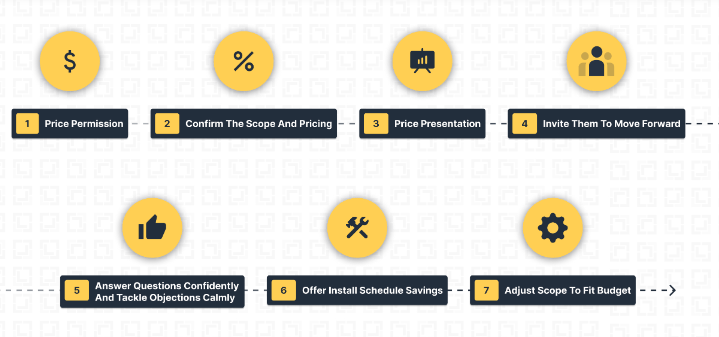

At One Click Contractor, this is addressed through the Path to Affordability™—a 7-step framework based on sales psychology that guides how price and payment are introduced so homeowners stay engaged instead of overwhelmed.

The Path to Affordability™ is built around a few core principles:

- Reduce cost anxiety early

Introducing payment options before the full price helps homeowners orient around affordability instead of reacting to a large number.

- Match how people process affordability

Monthly payments are easier to evaluate than lump sums, which keeps the conversation moving forward.

- Create clear choices

Presenting defined payment paths helps homeowners focus on selecting an option rather than deciding whether to proceed.

- Use visuals to build confidence

Side-by-side views of cash and financing reduce confusion and help homeowners feel in control.

The result is a calmer price conversation, fewer stalled deals, and more consistent execution across your sales team.

Implementing a consistent framework solves the biggest struggle in home improvement: rep inconsistency. Standardizing the process removes the complexity of financing, helping new hires sell with the confidence of a seasoned pro from day one.

👉 Learn more about the Path to Affordability™

Step 3: Closing the Momentum Gap (Signature to Funding)

The biggest risk to a financed deal is the "momentum gap"—the time between the homeowner saying "yes" and the project actually being funded.

If your process is slow or disjointed, the deal can lose momentum fast. Homeowners who have to wait too long start second-guessing the decision, shop competitors, or simply change their minds. And in financed deals, delays create another risk: Loan Expiration, where the customer’s approval expires before the project even begins.

To ensure your approved deals actually turn into revenue:

- Capture the eSignature On-Site: Do not leave the house without a legally binding signature.

- Finalize Payment Logistics Now: Use an integrated system to process deposits or down payments immediately through the same workflow.

- Manage by the Numbers: You can’t improve what you don’t measure. Use a dashboard to track key metrics like approval rates, take rates, and average ticket size by rep. This visibility allows you to identify which reps are successfully using the framework and which ones need more coaching to stop good deals from stalling.

How 1LOOK® Supports Contractor Financing

1LOOK® is the only financing platform built by home improvement pros, specifically for home improvement contractors.

It stands on its own as a powerful financing solution, and when paired with One Click Contractor’s estimating platform, it gives contractors a complete system to sell and fund jobs in one flow.

With 1LOOK®, your team gets:

- One application across lenders

Reps use a single, guided form instead of juggling portals or re-entering information.

- Best-fit lender routing

Each application is sent to the lender most likely to approve and fund, based on real approval behavior.

- Controlled offer presentation

Financing options are presented in a clear, consistent flow that keeps homeowners focused.

- Visibility into rep performance

Reporting shows approval rates, take rates, and financed ticket size by rep, so managers know exactly where deals stall or succeed.

- Coaching driven by real numbers

1LOOK® 's team works with leadership to review performance data, coach reps, and tighten execution where it matters most.

- Hands-on guidance focused on business success

Ongoing support helps contractors refine lender mix, pricing strategy, and financing usage so the program drives growth, not just activity.

If you want to see how top contractors integrate pricing, financing, and execution into one repeatable process, book a demo with One Click Contractor and 1LOOK® and see how it works in a real appointment.

Frequently Asked Questions About Contractor Financing

Why should contractors offer financing?

Contractors should offer financing because it removes cost as the primary barrier to closing deals and increases both close rates and average project size. When financing is presented early and clearly, homeowners are more likely to approve the full scope of work instead of cutting projects down, requesting heavy discounts, or walking away to competitors who make payment options simple and accessible.

What are financing options for contractors?

Financing options for contractors include third-party multi-lender platforms, single-lender partnerships, and in-house financing. The most effective approach is a multi-lender platform with automatic waterfall routing, one standardized application, and integrated tools for offer presentation and eSignatures. This maximizes approvals while minimizing admin work and compliance risk.

How do contractors offer financing to their customers?

Contractor financing is typically offered through third-party platforms that connect your business to a network of lenders. Instead of homeowners seeking personal loans independently, the contractor provides a digital application during the sales appointment. Modern systems use "soft-pull" technology, allowing the contractor to show qualified payment options instantly without affecting the customer's credit score.

What is a dealer fee in contractor financing?

A dealer fee in contractor financing is the percentage a lender charges to fund a customer’s loan, typically around 2–4% for standard programs. While it shows up as a cost, contractors usually lose far more revenue by not offering financing at all—through stalled deals, lost jobs, or heavier discounting—than they ever pay in a dealer fee.

What is the best contractor financing for customers?

The best contractor financing for customers offers clear monthly payments, soft-pull applications that don’t affect credit scores, and fast approvals. Multi-lender platforms increase approval likelihood by matching each application to the lender best suited for the customer’s credit profile, with offers available in-home during the appointment.